missoula property tax increase

Outside the reappraisal costs the budget adopted by the county will increase property taxes by 1021 for a 350000 home outside city limits. Yearly median tax in Missoula County.

Missoula County Adopts Fy22 Budget State Reappraisals Lead To Property Tax Increase Missoula Current

Outside the reappraisal costs the budget adopted by the county will increase property taxes by 1021 for a 350000 home outside city limits.

. The Missoula County Board of Commissioners adopted Tuesday the countys budget for the 2021 fiscal year which includes a slight increase to property taxes to fund costs and programs relating to. Missoula County Detention Center. Missoula County has one of the highest median property taxes in the United.

Add in a personal property tax rate of 016 percent and that brings up the total cost to 19045. Missoula County collects on average 093 of a propertys assessed fair market value as property tax. The mill levy math is done and property taxes are increasing for some property owners in Missoula County.

The notices for the 2019-2020 appraisal cycle are. The value of your property directly affects the property taxes you pay to schools Missoula County and the City of Missoula. Missoula City-County Health Department.

Theres a not-so-old saying that to err is human to really foul things up requires a computer. The county reviewed over 100 new requests for funding this year said Henthorne. Under the ballot proposal property taxes would increase by roughly 540 per 100000 in taxable home value annually according to the nonprofits calculations.

Missoula County Administration Building. You are visitor 4885772. Yearly median tax in Missoula County.

During the three years prior. The accuracy of this data is not guaranteed. The value of commercial property in.

Property Tax data was last updated 04072022 0700 PM. Average Missoula County home 15 assessed value increase to 350000 for fiscal year 2022 140 increase in county portion of property taxes. If the tax increase is approved by voters Missoula Aging Services will be able to help more people age in their homes which is by far the most affordable option Sheppard.

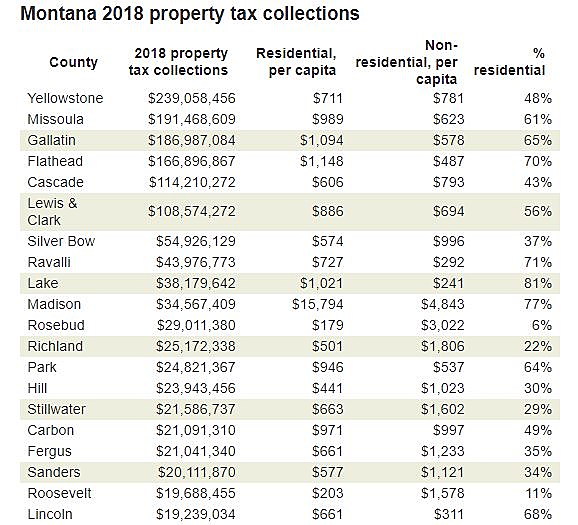

Average increases for residential property in the most populous counties ranged from 7 in Yellowstone County to the 23 high in Gallatin County. Residents inside the city will see no tax increases resulting from the countys budget. Missoula County Courthouse Annex.

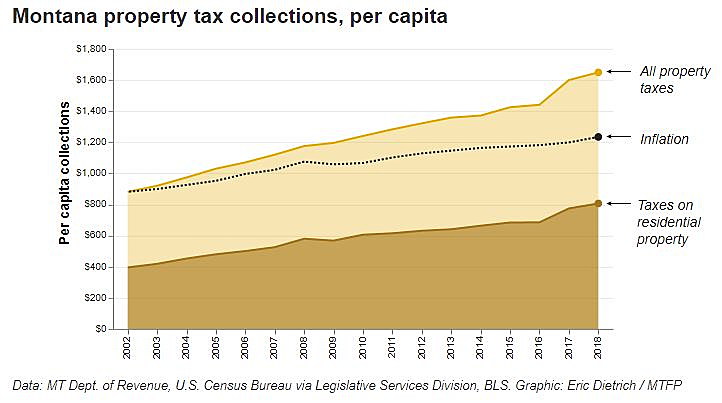

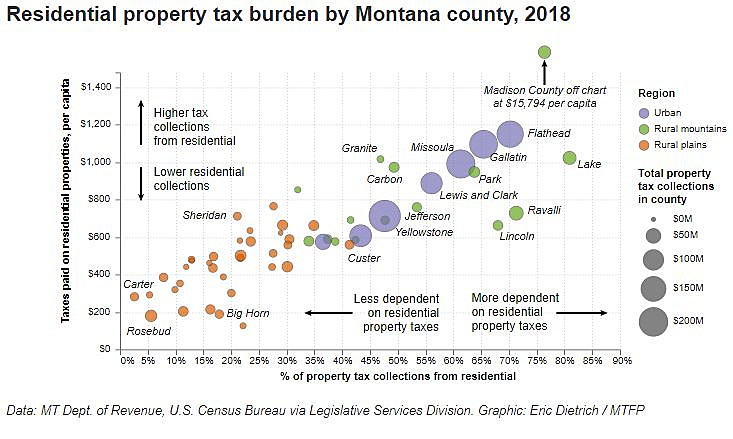

In 2019 Montanas property tax rate was 10th at a rate of 1509capita and the 19th highest in monies collectedcapita in the US. Missoula County Community and Planning Services. Ravalli County clocked in at second-highest in this group at 123 Missoula was 121 Flathead 11 Lewis and Clark at 95 and Silver Bow and Cascade counties at about 9 each.

Missoula County Animal Control. Outside the reappraisal costs the budget adopted by the county will increase property taxes by 1021 for a 350000 home outside city limits. Counties in Montana collect an average of 083 of a propertys assesed fair market value as property tax per year.

MIssoula County Grants Community Programs. In fact if you took that homes property taxes in 2016 and applied the national average property tax increase. County Services City of Missoula home 0 overall increase for county services andvoter-approved bonds Missoula County home 1021 increase for county services and voter-approved bonds.

Property Tax data was last updated 05112022 0700 PM. The Department of Revenue a division of the State of Montanas government determines the market value of residential and commercial property once every two years. 093 of home value.

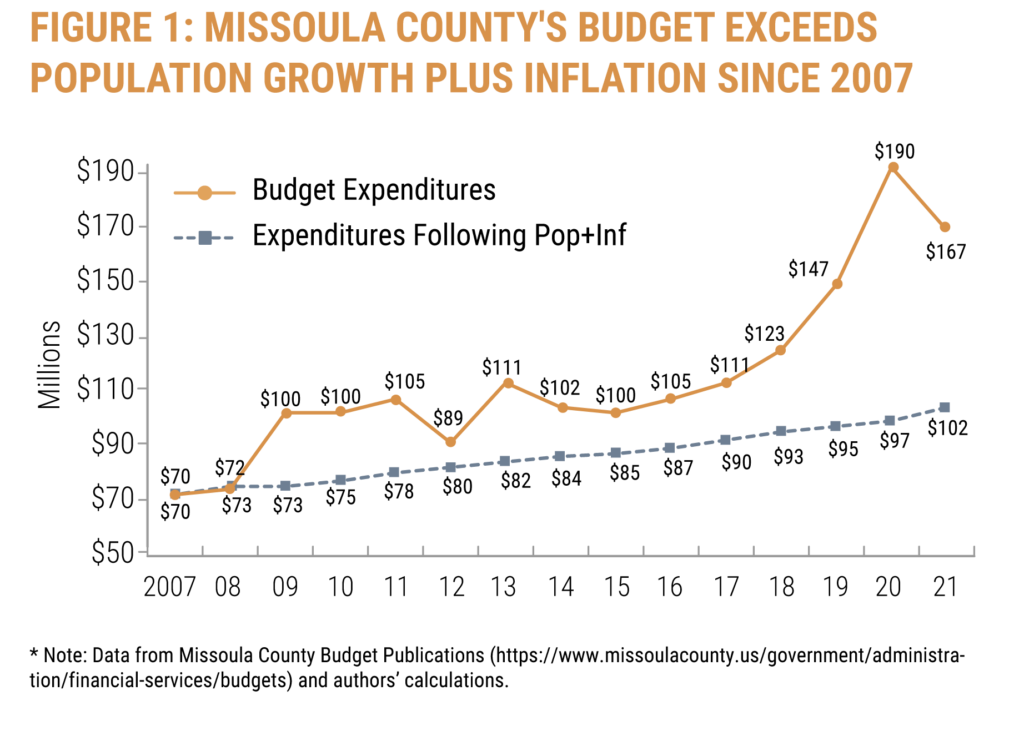

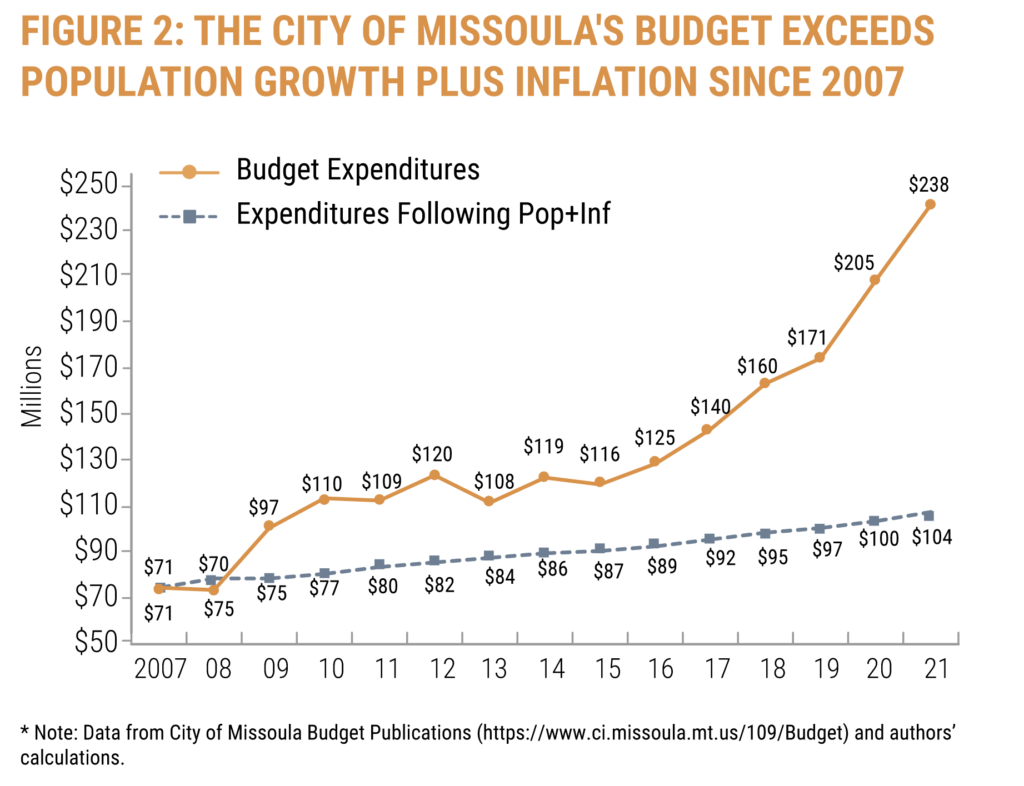

Tax amount varies by county. Missoulas problems are even worse when compared to property tax increases nationally which increased at an average rate of 32 between 2016 and 2020. The fiscal year 2021 budget for Missoula County will raise taxes for residents with a 350000 home who live outside the city limits and only pay county taxes an additional 1436 per year.

Property tax increases set following NorthWestern Energy settlement. Montana is ranked number twenty nine out of the fifty states in order of the average amount. The median property tax in Montana is 146500 per year for a home worth the median value of 17630000.

Residents inside the city will see no tax increases. Thats more than double the rate of the house with the smallest increase in our analysis house three. The Missoula County Board of Commissioners adopted Tuesday the countys budget for the 2021 fiscal year which includes a slight increase to property taxes to fund costs and programs relating to equity affordable housing criminal justice reform and sustainability.

The median property tax in Missoula County Montana is 2176 per year for a home worth the median value of 233700. Missoula mayor proposes property tax hike to pay for 385 percent increase in city spending.

Proposed 2022 Initiative Would Cap Montana Property Taxes Assessment Values Missoula Current

If Gas Tax Revocation Increases Property Taxes Missoula County Ready To Say Why The Legislature

Property Taxes Missoula County Blog

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current

Analysis Average Priced Missoula Homes Seeing Massive Property Tax Increases

Property Taxes Missoula County Blog

Property Taxes Missoula County Blog

Analysis Average Priced Missoula Homes Seeing Massive Property Tax Increases

Ci 121 Montana S Big Property Tax Initiative Explained

Analysis Average Priced Missoula Homes Seeing Massive Property Tax Increases

New Policy Brief The Real Missoula Budget

Montana Property Taxes Keep Rising Here S Where Residents Shoulder The Heaviest Loads Montana Free Press

Property Taxes Missoula County Blog

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current

Analysis Average Priced Missoula Homes Seeing Massive Property Tax Increases

Property Taxes Missoula County Blog

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current